As an anime figure collector, you're likely aware that the best figures often come from Japan. However, buying directly from Japan can involve more than just paying the listed price due to potential import taxes and fees that can significantly increase the overall cost.

When importing figures, you may encounter various taxes such as VAT, import duties, and customs fees, which are usually imposed by your local government. These charges can sometimes add 150% or more to the original price, making what seemed like a great deal much more expensive.

In this guide, we'll first explain the general rules of import taxes and the factors that influence whether your package will be taxed. Then, we'll dive into specific scenarios based on your country to give you a detailed understanding of your potential costs and how to manage them effectively.

Understanding Import Taxes

Not all packages are subject to import taxes, and even if they are, not all of them will actually be taxed in practice. The likelihood of your package being taxed can vary based on several factors.

When you import items from abroad, your local government wants to tax these goods, and the responsibility for paying these extra fees falls on you, the buyer. The price you see on the online shop doesn’t include these potential fees, which are typically requested by your delivery company upon arrival.

There are many scenarios where you might not pay any tax at all. However, international trade is very complex and depends on a variety of factors, such as the specific shop you are buying from and the regulations of your country. We will explore these details to help you understand how these taxes might apply to you.

Types of Taxes on Anime Figure Imports

VAT (Value Added Tax) or GST (Goods and Services Tax): These are consumption taxes applied by your country when you purchase goods. If a company sells a product excluding VAT, a certain percentage amount will be added to the value, and this extra amount is collected by your country’s government. For example, when buying from Japan, you shouldn’t pay the Japanese consumption tax (10%), but you will need to pay the VAT of your own country.

Import Duties: These are additional taxes imposed on goods when they enter your country’s territory. Import duties are designed to avoid competition with local products and encourage people to buy from the local economy. The percentage of import duties can vary based on the type of product and the country.

Customs Fees: When your package is stopped by customs and the delivery company requests you to pay VAT and import duties, you might also be charged extra customs fees. These fees cover administrative costs as the delivery company handles the paperwork and customs clearance for you.

It's important to note that in most cases, none of these fees are included in the price you see on the online shop, because these fees are collected by your country’s government, not the seller.

Do I Need to Pay Taxes? General Factors

Whether you need to pay taxes on your imported anime figures can be somewhat random, but there are several factors that can influence the likelihood of being taxed.

Your country: Different countries have different rules and enforcement levels regarding import taxes. For example, in the US, it is less likely that small packages will be taxed compared to other countries.

Amount value: Each country has a de minimis threshold, which is the value below which goods can be imported without paying taxes. The threshold varies from country to country.

Delivery company you choose: The choice of delivery company can also affect whether your package gets taxed. Some companies have higher rates of packages being stopped by customs than others.

Agreements between big online shops and delivery brokers: Some large online shops have agreements with delivery brokers to handle customs processes, which can sometimes reduce the likelihood of being taxed or simplify the process.

Understanding these factors will help you gauge the likelihood of your package being taxed and plan accordingly. In the following sections, we will explore these criteria in detail for various countries.

Overview of the entire delivery process

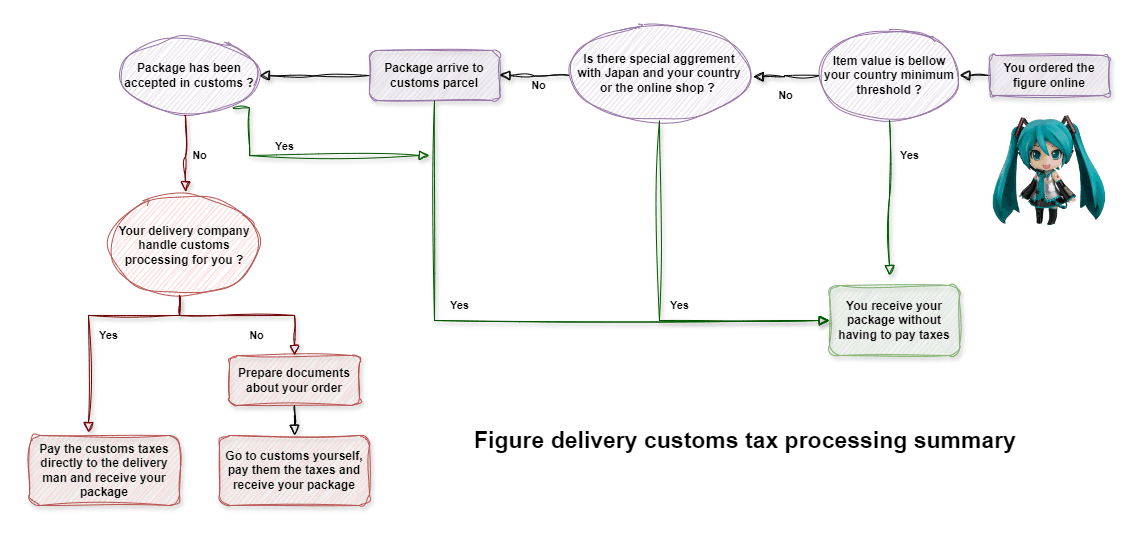

delivery process - click to see all

When you order an anime figure online from Japan, the package will first arrive at your country's customs parcel section. Customs will then determine if the package needs further inspection. If there's a special agreement between Japan and your country, or if the item's value is below your country’s minimum threshold, you might receive the package without having to pay additional taxes.

If the package is accepted for customs inspection and there are no special agreements, the next step depends on whether your delivery company handles customs processing. If they do, you'll pay the customs taxes directly to the delivery person. If not, you'll need to prepare the necessary documents and visit customs yourself to pay the taxes and retrieve your package.

Understanding this process helps you anticipate potential steps and prepare for any customs-related requirements, ensuring a smoother experience when importing your anime figures.

Under valuated Package Option

The minimis threshold is the value below which goods can be imported without paying taxes. Each country sets its own threshold, which means that if the value of your package is below this amount, you won’t have to pay any import taxes or duties. Understanding your country’s de minimis threshold can help you plan your purchases to avoid extra costs.

Some online shops offer the option to mark the package as a gift or to undervalue the package, which can reduce the chances of paying taxes. However, this practice can be risky as customs authorities may inspect the package and assess its true value. If they find discrepancies, you could face penalties and additional fees.

Additionally, when you undervalue your package, the declared value is also used as the insured value. This means that if there is an issue with your package, such as damage or loss, the compensation you receive will be based on the lower declared value, which might not cover the full cost of the item.

To minimize tax liability, consider purchasing items that fall below the de minimis threshold, or check if the seller offers legitimate ways to reduce the declared value. Always be aware of the potential risks and legal implications of undervaluing packages, as well as the impact on your insurance coverage.

Amazon is often the best option

Even though Amazon is not specialized in anime figures and may have fewer options compared to dedicated retailers, it stands out significantly when it comes to handling taxes and duties. Amazon has established numerous special deals with countries and delivery companies, which puts it in a completely different league.

Regardless of where you live, Amazon will clearly indicate if there are customs fees to pay before you place your order. This transparency ensures that you won't be surprised by unexpected customs charges upon delivery. Amazon handles the entire customs process for you, providing a hassle-free shopping experience.

Additionally, even if you don’t live in Japan, Amazon often has anime figures available for international shipping. This means you can find figures that can be delivered directly to your country without any issues. For instance, you can see anime figures that deliver to your country here.

By leveraging Amazon’s extensive logistics network and clear customs handling, you can enjoy a smoother and more predictable shopping experience for your anime figure collection.

Customs duties and taxes in USA

Collectors in the USA are quite lucky when it comes to import taxes. The general rule is that for orders under $800, you have almost no chance of paying customs tax. This high threshold allows for substantial purchases without the worry of additional fees.

In terms of delivery service, packages sent via EMS have a lower chance of being subject to taxes compared to those sent via DHL. This can help reduce the likelihood of facing unexpected charges.

On the rare occasion that your package is hit by customs, the total fees are generally reasonable. However, it's important to note that if you do have to pay fees, the amount will depend on your state, as regulations vary.

Customs duties and taxes in Australia

Collectors in Australia are also quite fortunate regarding import taxes. For orders below 1,000 AUD, you don’t have to pay any import taxes or duties. This generous threshold allows you to purchase freely as long as your order total does not exceed 1,000 AUD per shipment.

To maximize your savings and avoid any additional charges, make sure to keep your individual orders under this 1,000 AUD limit. This way, you can enjoy your anime figures without worrying about extra costs.

Customs duties and taxes in Canada

In Canada, there is a high chance of getting taxed on imported goods. This makes it important for collectors to be aware of potential extra costs.

Shipping via EMS generally has a lower chance of being taxed compared to DHL. Choosing EMS can sometimes help reduce the likelihood of paying additional taxes and fees.

Canada also has some fixed minimum fees that apply to imports, which can make it less economical to import low-value items. The fixed fees might exceed the basic price of the item, so it's often better to avoid importing low-value goods.

Customs duties and taxes in Europe

In Europe, the rules for import taxes can vary from country to country, but a general rule is that you are not subject to customs tax for orders below 150€. This minimum threshold is relatively low, so it may be a better idea to make multiple small orders to avoid taxes.

Some online shops offer the option to undervalue your package so it falls below the minimum threshold, but be mindful of the related risks, such as lower insurance coverage and potential penalties.

If you do have to pay customs duties on your package, the amount will vary from country to country. You can consult the specific values for your country here.

Also, note that in Europe, there is a special VAT scheme called International One Stop Shop (IOSS). If the online shop supports it, the shop will include all the taxes in the price. So if you live in Europe, check if the website mentions OSS to simplify your purchasing process.

Customs duties and taxes in the UK

In the UK, you do not have to pay taxes on orders below 135£. This allows collectors to make smaller purchases without incurring additional costs.

For orders above this threshold, you will have to pay import taxes. The total amount of tax can range from 5% to 20% depending on the type of goods and their value.

To minimize costs, it’s advisable to keep individual orders below the 135£ threshold whenever possible. This strategy can help you avoid the extra expense of import taxes and keep your hobby more affordable.

Customs duties and taxes in Asia

The tax situation in Asia varies significantly from country to country. For instance, in countries like Russia, Singapore, the Philippines, and South Korea, you generally do not have to pay taxes on orders below around 150$.

Other countries in Asia may have significantly lower minimum thresholds, meaning you could be subject to import taxes on smaller purchases. It's important to be aware of your specific country's regulations to avoid unexpected costs.

The range of tax amounts can also be quite wide. To get the most accurate information, you should consult the relevant customs and import guidelines for your country. You can find more detailed information here.

Calculation of the Total Tax Amount

To understand how import taxes and fees can affect the total cost of your anime figure, let's go through a detailed example. We'll use a base price of $100 (without Japanese VAT), with a local country VAT of 10% and import duties of 15%. Additionally, there is a fixed amount of $10 for extra fees because the delivery company handles the customs paperwork.

Step 1: Calculate Import Duties

Import duties are calculated as a percentage of the base price. For our example:

Base price: $100

Import duties: 15% of $100 = $15

Step 2: Calculate VAT

VAT is calculated on the total cost, which includes the base price plus import duties. For our example:

Total before VAT: $100 + $15 = $115

VAT: 10% of $115 = $11.50

Step 3: Add Extra Fees

The delivery company charges a fixed fee for handling the customs paperwork. For our example:

Extra fees: $10

Step 4: Calculate the Total Cost

Now, sum up all the costs to get the total amount you will pay:

Base price: $100

Import duties: $15

VAT: $11.50

Extra fees: $10

Total cost: $100 + $15 + $11.50 + $10 = $136.50

Therefore, the total amount you will pay for the anime figure, including all taxes and fees, is $136.50.

Price Tips: Don’t Overpay the Japanese VAT

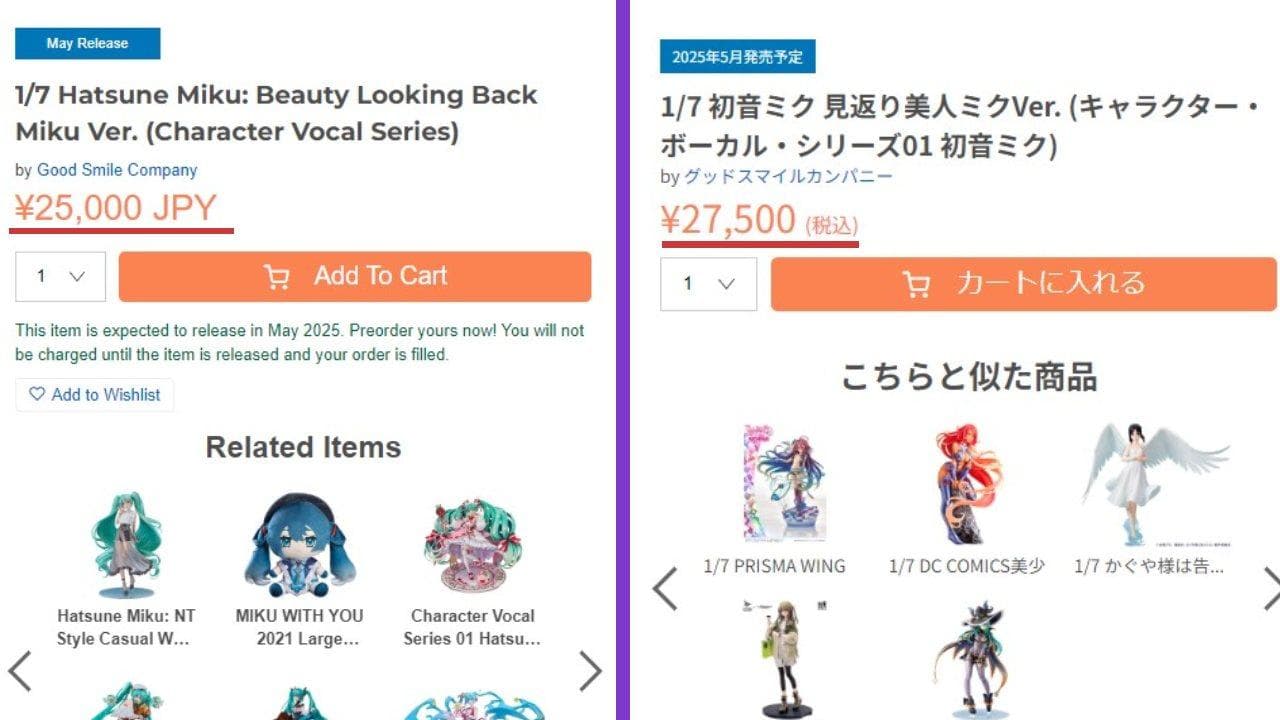

International VS Japanese version shop

When buying anime figures from Japanese websites, it's important to be aware of potential overcharges related to the Japanese consumption tax. Some Japanese websites and their international versions may display the same price for an item, but this price often includes the 10% Japanese consumption tax.

As an international buyer, you are not supposed to pay the Japanese consumption tax. Instead, you should only be responsible for paying the taxes applicable in your own country, such as import duties and VAT.

To avoid overpaying, look for websites that explicitly state they exclude Japanese consumption tax for international orders. If the website does not mention this, consider reaching out to their customer service to confirm whether the displayed price includes the Japanese tax. This way, you can ensure that you are not paying unnecessary extra charges and only pay the appropriate local taxes. Typically Anime Figures in Amazon JP doesn't overcharge Japanese consumer tax.

Always compare prices between the Japanese and international versions of the website to make sure you’re getting the best deal. Being aware of these details can save you money and help you manage your budget more effectively.

Taking Charge of Your Collection

Understanding the various taxes and fees associated with importing anime figures can seem daunting, but with the right knowledge and preparation, you can navigate these complexities with ease. By being aware of import duties, VAT, and customs fees, you can make informed decisions that help you manage costs effectively.

Remember to research your country's specific regulations and thresholds, choose shipping methods wisely, and consider the total cost of your purchases, including potential taxes. Take advantage of tips like avoiding the Japanese consumption tax and strategically planning your purchases to minimize extra costs.

With these strategies, you can take charge of your anime figure collection, ensuring a smoother and more cost-effective importing process. Enjoy your collecting journey, and may your collection continue to grow!

You can explore figures here.

More info about the author

NivixX

NivixX is a passionate developer and anime enthusiast who created MyFigureList, a platform designed to support the figure collecting community. The site helps users explore detailed figure pages, track collections, and connect with fellow fans.